High-level plans for St. Albert’s recently annexed lands in the northwest are set to return to a council committee Oct. 11.

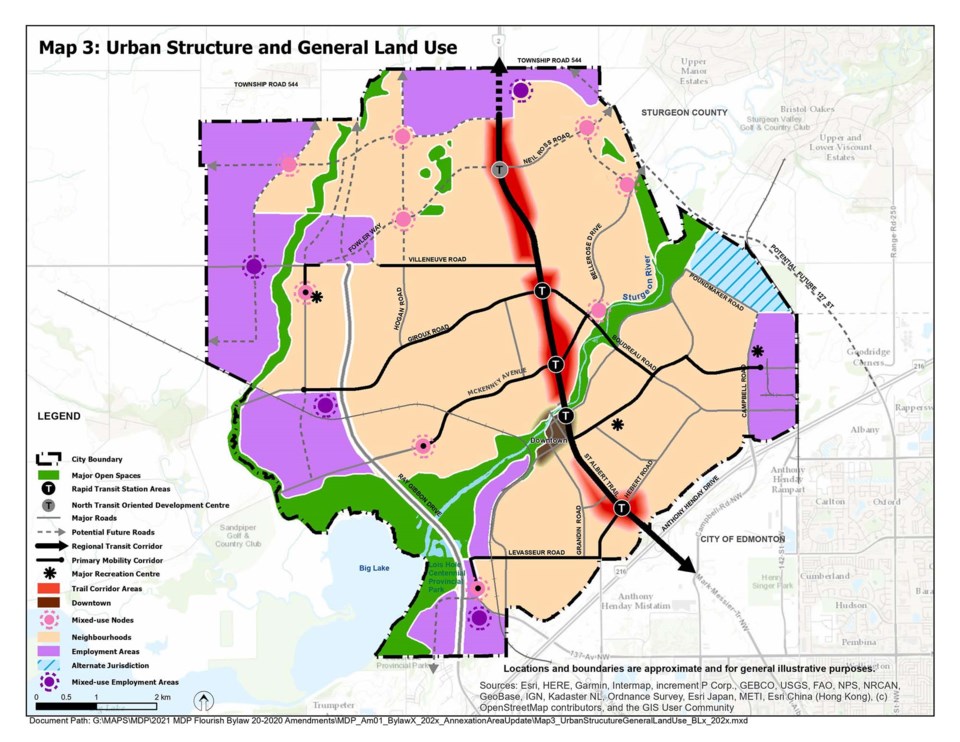

The City of St. Albert expanded its land boundary Jan. 1 following a successful annexation agreement with Sturgeon County. Incorporating these lands into the city’s high-level planning document — the Municipal Development Plan (MDP) called “Flourish” — is a key step for the city in shaping future development.

Council was initially slated to approve the plans during a meeting back in May, but pumped the brakes, citing the need for additional council involvement in how the lands are outlined for future development. In an email, city spokesperson Cory Sinclair said the city will not share details about what will come to committee in advance of the agenda being released on Friday, Oct. 7.

The MDP draft brought to council in May outlined the areas the city intends for employment (land targeted for light industrial development); areas the city has pinpointed for residential growth; and mixed-use nodes — areas designed for multiple purposes, including housing and commercial and retail use.

The draft amendment also introduced new policies for the MDP, including one allowing agricultural activities to occur within the annexation area until the lands are used for urban growth and development.

A second new policy would work towards achieving a tax assessment split of 60 per cent residential assessment and 40 per cent non-residential assessment within the annexation area.

Amendments require more input: council members

The proposed amendments were based off studies conducted as part of the annexation application process, including public engagement through open houses and the city’s Cultivate the Conversation website.

When it came time to vote on updating the MDP according to these new policies, council members said they felt they hadn’t been properly included in the planning process, citing the need for more council guidance in determining the direction of the city’s future.

One change council members highlighted as needing more consultation was a change to the MDP’s wording, where the term "tax revenue" was replaced with "tax assessment.”

The swap would change how the city calculates its tax split between residential and non-residential assessment.

While tax assessment is the total estimated value of residential and non-residential properties owned within St. Albert, tax revenue is how much those different assessments each contribute to the taxes the city brings in, as determined by residential and non-residential tax rates.

Currently, St. Albert’s tax assessment is split at 84.6 per cent residential and 15.4 per cent non-residential, whereas the tax revenue split is 79.3 per cent in residential tax revenue versus 20.7 per cent non-residential.

This is because the current total residential tax rate is 11.10329, while the non-residential rate is 16.13892.

Changing the policy to focus on tax assessment would mean the city’s goals of increasing the non-residential portion of the split are more difficult to reach.

Coun. Mike Killick said during the council meeting he would need “several hours” before he would be ready to approve the switch to tax-assessment wording.

The MDP amendment is set to return to a committee of the whole meeting on Oct. 11.

Those interested in attending can watch the online live stream here: https://stalbert.ca/cosa/leadership/meetings/council-live