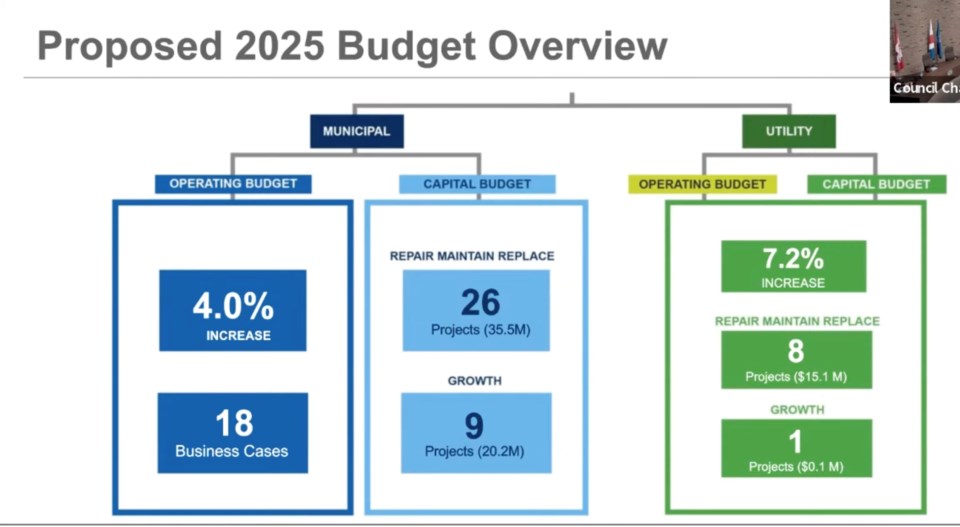

St. Albertans are looking at a 4.0 per cent municipal tax hike in 2025.

A recently approved increase to the franchise fee the city collects from utility bills averted a 4.5 per cent tax increase. At 4.0 per cent, tax bills would increase on average by $34 per year per $100,000 of assessed value.

Councillors begin budget presentations today, Oct. 22, and will continue Oct. 24 and 29. Meetings where councillors can ask questions and debate items are scheduled for Nov. 5, 25 and 27 and Dec. 5. If all goes as planned, staff expect council to pass the budget Dec. 17.

Residents can provide feedback on the draft budget via a survey on the city's website.

Significant changes to city revenues include:

- Gain of $4.5 million from sales and user fees to things like park rentals and utility rates

- Gain of $1.5 million in investment income

- Gain of $600,000 from new ambulance service contract with AHS

- Gain of $500,000 in franchise fees due to city growth and rate change

- Gain of $100,000 from license and fee increases

- Gain of $100,000 via transfer from reserves

- Loss of $1 million due to changes related to photo radar rules by the province

- Loss of $400,000 in transfers from two provincial programs

According to the introduction from city CAO Bill Fletcher, the overall operating budget for 2025 is proposed to be worth $216.2 million and features 15 new enhancements that support council’s stated priorities funded by assessment growth, meaning they won’t add to the tax increase.

Data he presented to council Tuesday show St. Albert has among the lowest operating costs per capita in Alberta. At $3,129, it's lower than Calgary, Edmonton, Parkland County and Grande Prairie.

Fletcher added that on average over the last 10 years, St. Albert's tax increases also are lower than those of Lethbridge, Medecine Hat, Leduc, Edmonton and Calgary.

Significant changes to St. Albert operating expenses would include:

- Up $5.5 million due to required 1.5 per cent hike in transfer to repair/replace reserve

- Up $3.0 million relating “to corporate contingency and an increase to the City’s Recreation and Transit subsidy program to match demand”

- Up $2.1 million on government services, i.e. RCMP and Arrow Services

- Up $1 million on regular salary increases

- Up $1 million on increases to price of gas, electricity delivery costs

- Up $700,000 on contracted services such as the 2025 election, snow removal and IT

- $300,000 increase to library transfer and to election reserve

- Down $1 million in payments for land for Fire Hall #4 and Servus Credit Union Place

In terms of major projects, the draft 2025 capital budget lists 26 projects worth a total of $55.7 million. Fletcher writes that they focus on “on repairing, maintaining and/or replacing existing municipal infrastructure, and nine capital charters that address community growth.”

The utility operating budget, meanwhile, is worth $54.6 million and will result in ratepayers seeing their bills increase by 7.2 per cent or $11.27 per month on average. The utility capital budget proposes $15.2 million worth of work across eight repair/replace projects and one that addresses community growth.

Fun with numbers: operating

- Proposed tax increase: 4.0 per cent

- Approved utility franchise fee change: 25 per cent, up from 20 per cent

- Average annual tax per $100,000 of assessment: Plus $34 to $902

- “Typical” monthly utility bill: Up $11.27 to $167.78

- Number of employees of city council: 1, the CAO

- Number of city workers the CAO oversees: 709.5 FTE, plus seasonal and other non-permanent staff

- Area of St. Albert after 2021 annexation: 6,531 acres

Fun with numbers: capital projects

- Work on civic property: $17.9 million

- Mobile and other equipment: $17.4 million

- Roads and other structures: $11.4 million

- Parks and trails: $7.2 million

- Wastewater infrastructure: $7.3 million

- Water infrastructure: $4.7 million

- Stormwater infrastructure: $3.2 million