City staff recommend St. Albert go ahead with 10 infrastructure projects in 2025 and push back digging in on another nine.

The analysis is included in the draft 2025 municipal budget and business plan, which was tabled Tuesday, Oct. 22.

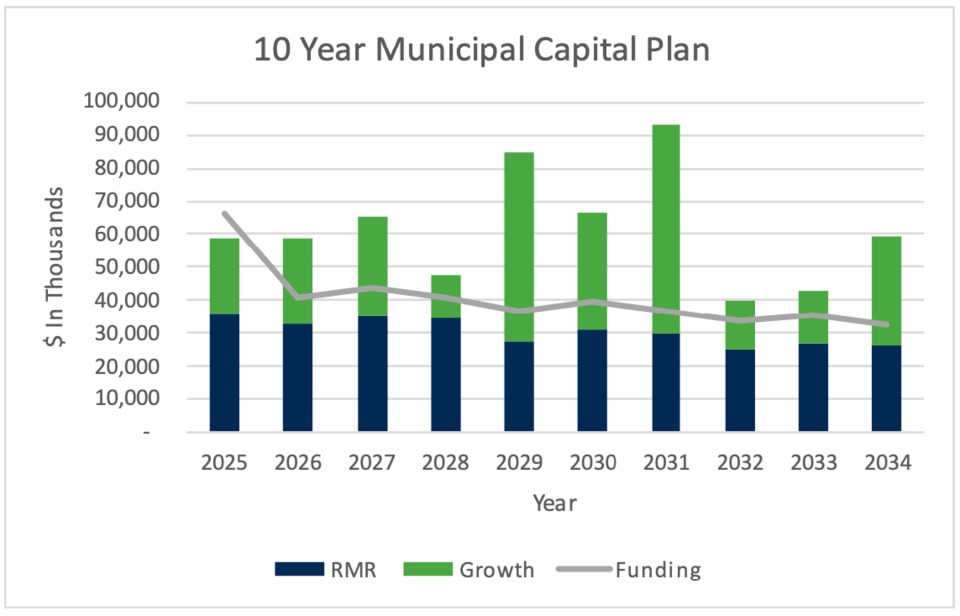

The 10 Year Municipal Capital Plan outlines $813 million in capital investment, of which $304 million is attributed to repair, maintain and replacement (RMR) projects, and the remaining $509 million is for growth-related initiatives.

Plowing ahead with every new road and sewer main on the books would bankrupt the city, so staff spread the work out over 10 years. They recommend nine municipal infrastructure works worth $20.2 million and one utility project valued at $123,000 — a non-potable water filling station for city trucks at the Jensen pump station — go ahead in the coming fiscal year.

Projects city staff recommend go ahead in the coming year include:

- Transit Garage (Liggett Place) Expansion: $10.6 million

- RWP West - Meadowview Construction: $4.7 million

- New Neighbourhood Park Development: $2 million

- Roadway Preliminary Engineering and Design: $650,000

- Active Transportation (10-year program for new sidewalks): $595,000

- Neighbourhood Traffic Calming: $483,000

- Badger Lands Site Plan: $330,000

- Founders Walk Phase 3: $264,000

- Public Art: $263,000

- Transportation Network Improvements: $110,000

In terms of maintenance, St. Albert city council approves that part of the capital budget earlier in the year. For 2025, the RMR budget was locked in June 4 with 31 projects worth $50.6 million, including eight utility projects worth a combined $15.1 million.

In general, the city counts grants from senior levels of government as "the primary source of funding" for infrastructure, using debt, reserves and tax dollars when projects don't qualify.

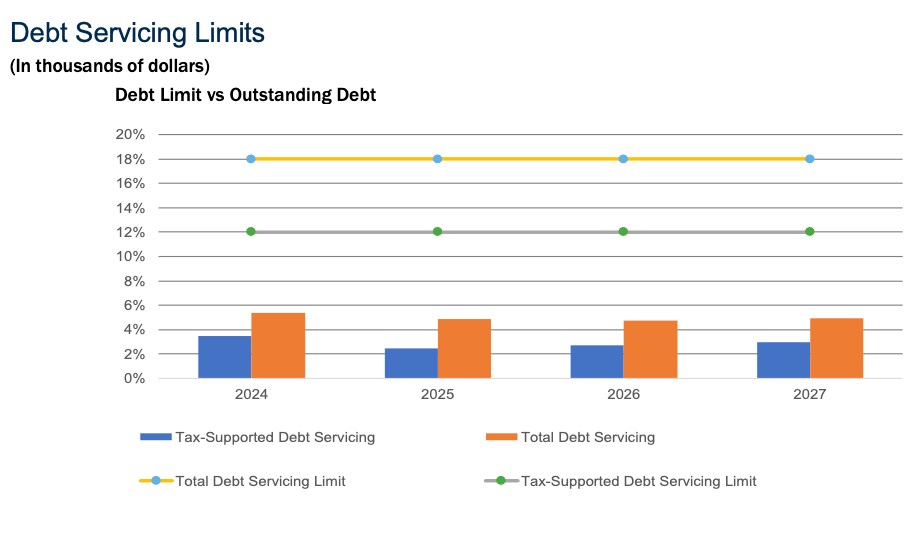

Rules set by the province and the city itself dictate how much debt the city can carry. An update to the municipal policy made in Q2 of 2024 means councillors can borrow as much as 18 per cent of the operating budget for total debt servicing, and as much as 12 per cent for tax-supported debt servicing specifically.

For us laypeople, the math shakes out to St. Albert having $13 million in debt servicing payments, "which is considerably lower" than the current limits allow for, according to the budget.

Most of the debt incurred by the City of St. Albert is "tax supported and paid from operations through the generation of tax revenue," according to the budget. "However, the city has also undertaken debt to front end capital projects related to new development which are offsite leviable and will eventually be charged to developers," as is the case with the recent decision to service the Lakeview Business District in the city's southwest. "These projects are funded from the city’s Offsite Levy

Recovery Fund reserve and thus, have no impact on the tax base."

Of the $114.7 million outstanding in 2025, $54.4 million will be tax-funded and $60.3 million will be non-tax funded, according to the budget.