St. Albert store owners scrambled last week to adjust their prices to account for a two-month GST holiday introduced by the federal government.

Bill C-78 received royal assent on Dec. 12. The bill eliminates the Goods and Services Tax on a long, very specific list of items purchased between Dec. 14, 2024, and Feb. 15, 2025. The tax break was pitched by the Trudeau government as a way to address the high cost of living during the holiday season.

Amongst other items, the tax break applies to prepared foods and drinks, restaurant meals, beer, wine, snacks, children’s clothes and toys, printed books and newspapers, jigsaw puzzles, and Christmas trees.

A family spending $2,000 on such goods would save $100 during the break, background documents show.

With exceptions

The break comes with an extensive array of exceptions.

The break applies to candy bars bought at the till, for example, but not to ones bought from vending machines. Beer and physical books get the break, but not vodka or e-books. You’ll get the break if you buy a children’s book, but not if you buy a children’s colouring book.

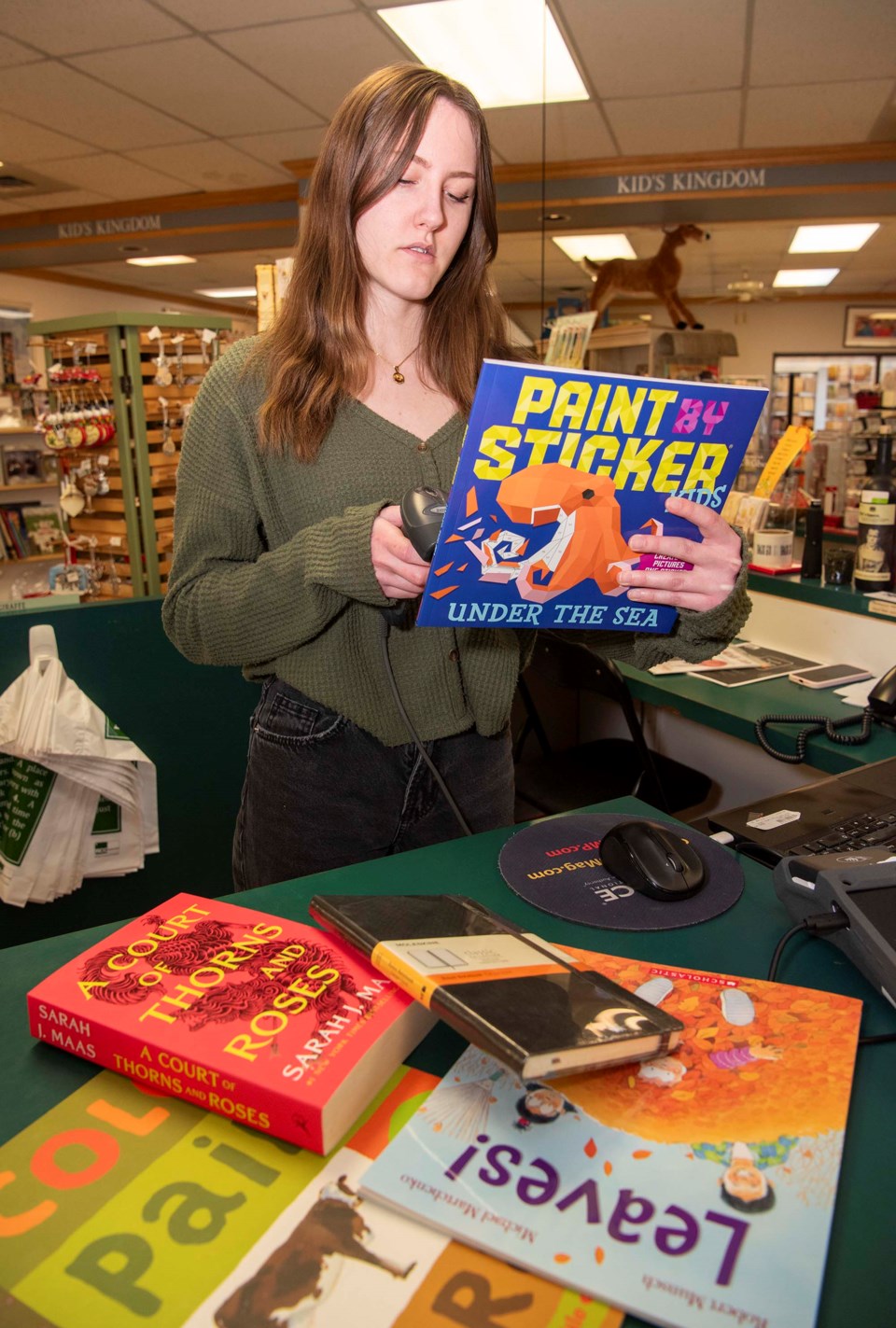

Kim Borle, owner of the Bookstore on Perron Street, said the tax break put a lot of extra work for her staff at a time when they were already dealing with the Christmas rush and the Canada Post strike. Her store carried a mix of exempt and non-exempt books, and she did not have the time to put new price tags on everything.

“We’ve got about 25 pages to read on how to set it up,” she said, and staff will have to scrutinize every item at the till to see if they should type in the “no GST” code for it.

Just Kids owner Almut Englberger estimated that the GST break applied to about 75 per cent of her stock. While she believed it would be easy for her to track exempt and non-exempt sales in her records (she used pen and paper), she said the tricky part would come when she has to pay the GST to the government, as she would have to account for sales before, during, and after the break period.

“I’m really going to have to do a lot of calculations.”

The tax break will affect the handful of readers that have a print subscription to the Gazette, said Evan Jamison, vice-president manufacturing for Great West Media, in an email. (The paper is available for free within St. Albert.) It’s less clear how the break will apply to subscriptions bought prior to the break or that were bundled with online editions.

No big deal?

Borle and Englberger did not think the GST break would affect their sales.

“My customers base is pretty set,” Englberger said, and most of her items cost less than $10.

An online Postmedia/Leger poll of 1,532 adults held Nov. 29–Dec. 1 found that just 32 per cent of Canadians thought the GST tax break would be helpful, with about half saying it would not change their holiday shopping plans. About 70 per cent believed the break was a ploy to get votes — a ploy that may have failed, as 65 per cent said it would not affect their support of the Liberals in the next election. (A similar randomized poll of this size would be accurate to within 2.5 per cent 19 times out of 20.)

St. Albert–Edmonton Conservative MP Michael Cooper said the tax break was “a tax trick introduced by a desperate government that will do next to nothing to make life more affordable.”

“It’s also an administrative nightmare for small businesses,” he continued, as it was complicated to implement and would have to be removed in just two months.

Cooper said the federal government should instead lift the GST on new home sales and eliminate the carbon tax to save Canadians money.

Information on the GST break can be found at bit.ly/3DoASPH.