What a difference a year makes in a housing market.

Fresh stats in the March Focus on Business newsletter from St. Albert Economic Development show a slight downward movement in numbers—with overall stability, still happy news for homeowners and homebuyers.

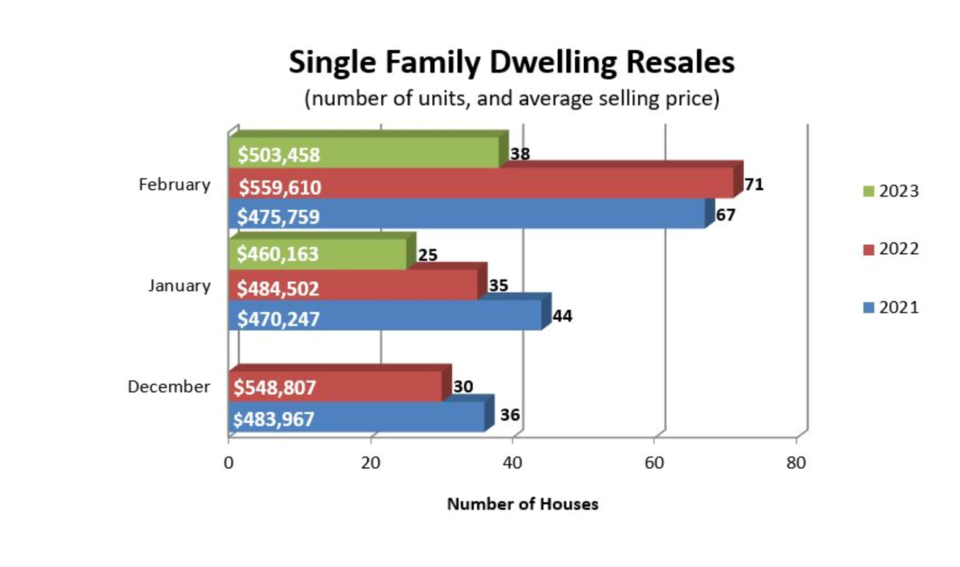

According to numbers pulled from the Realtors Association of Edmonton, single-dwelling sales in St. Albert have dipped from 71 YTD in 2022 to 38 YTD in 2023, with the average individual home price receding from $559,610 to $503,458.

The numbers are notable, but not particularly precipitous.

Dave Linklater, a Re/max Elite agent with Dave Linklater Real Estate in St. Albert said the slightly cooler market is still a very positive one, just not as flashy as last year’s hot market.

“A lot of people are comparing it to a year ago when it was a market that was virtually unheard of,” Linklater said.

Buying a new cocoon

After a three-month grinding halt in March 2020 with the pandemic’s onset, in St. Albert the demand for change-ups in housing arrangements actually rose during the Covid pandemic, prompted by new work-at-home, workout at home, and home schooling arrangements. Cocooning families reassessed things like how many bedrooms they needed, Linklater said.

By early 2022, between the seasonal winter fluctuation in market inventory (and sometimes a reluctance to have potential buyers in home), there were fewer homes on the market. To reduced supply, throw in an appealingly low interest rate, and demand built quickly.

Unusually low interest rates and pent-up demand from the Covid pandemic were prompting causing a buzz of new activity across Canada, Linklater said.

“When they saw interest rates at pretty much historic lows, they said, ‘Let’s do it,’” he recalled.

With re-energized buyers pre-approved for five-year fixed mortgages for under 2 per cent, “that prompted a lot of people to buy a first home or to move up,” Linklater said.

A year later, slightly softer single-family dwelling resales (and prices kicked down a notch) reflect nationwide numbers prompted by Bank of Canada interest hikes—efforts to cool hot market pricing in places like Vancouver, Toronto and the Okanagan that were pricing homebuyers out of the market.

The market cooled on demand.

Goldilocks market

Even with slight drops in the Greater Edmonton area—and St. Albert in particular—it’s something of a Goldilocks market: not too hot, not too cold—just right.

It’s steadier than in many other Canadian hot spots, Linklater said.

“We don’t really have the high peaks and the low valleys at lot of other markets do,” Linklater said.

“It’s called a balanced market. There’s enough inventory for buyers to have a decent selection, but there’s not too many,” he said, citing multiple offers on a few recent sales.

“When people take a long term look at it, it will temper your expectations back a little bit. Interest rates are up, but pricing has come down a bit. The Greater Edmonton market is still very reasonable, compared to a lot of regions in Canada,” Linklater said.

Free from the wild caprices of markets that blow hot or cold, St. Albert dwellers don’t always know how lucky they are, he said.

“There’s studies out there that show the price per home here, compared to our average wages, is the best ratio in Canada.”

Meanwhile, on the multi-family building permit front in St. Albert, numbers are way up year-to-date, from four issued in 2022, for a total of $1.9 million, to 22 issued year-to-date so far this year, for a value of over $5.3 million.