The City of St. Albert wants to bring a higher volume of businesses to new land it's in the process of annexing from Sturgeon County.

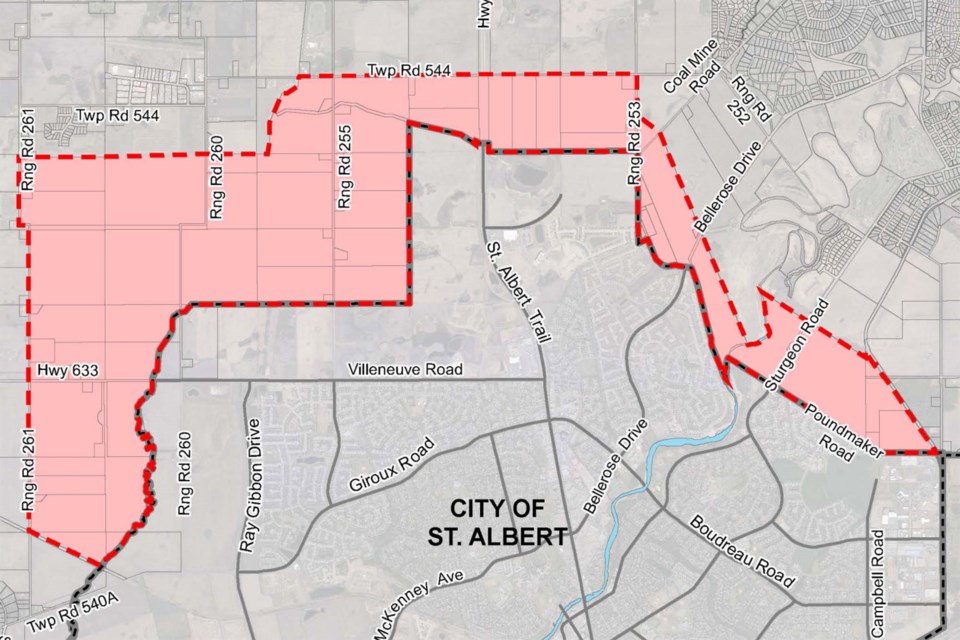

In April of 2021, Alberta's property rights tribunal held a public hearing for the annexation. The city is now expecting to hear back from the province within the next month, with the potential for the roughly 1,600 hectares of land to become part of St. Albert as early as January 2022.

Lyndsay Francis, senior planner for the city, outlined plans for the land during a public meeting over Zoom on Dec. 1. The plans include amendments to the city’s Municipal Development Plan (MDP), a high-level document outlining the city’s growth over the coming decades.

Francis said the city’s tax target of 70 per cent residential and 30 per cent non-residential is a major consideration for the plans. Currently, St. Albert’s tax base is split 80/20 between residential and businesses.

To provide more commercial tax assessment, St. Albert is looking to develop the annexation area with a 60/40 residential and commercial tax split. Francis said this will help the city “promote sustainability and reduce the reliance on residential taxes.”

Additionally, the city will prioritize the land northeast of St. Albert for development before development in the west annexation land occurs, Francis said. This includes the area northwest of St. Albert, divided at the midway point between Range Road 255 and St. Albert Trail.

“This policy is about ensuring that we’re appropriately phasing development, not leap-frogging into the annexation area, preventing premature fragmentation of agricultural land,” Francis said.

The last proposed policy will allow agricultural activities within the 2022 annexation area until further urban development and growth occurs.

For agricultural land, the city is proposing a transitional land-use district to allow for existing uses of land to continue, as well as allowing for subdivision.

Frank Booth, an event attendant, asked whether farmers within the annexed area will be subject to St. Albert franchise tax on natural gas and electricity usage.

“In other words, will our monthly utility bills remain subject to similar rate and taxes as our current contacts?” Booth asked in the Zoom question platform.

St. Albert senior planner Vicki Dodge said based off her work in another jurisdiction, once residents of Sturgeon County come into St. Albert, they must pay whatever franchise fees the urban municipality pays.

“If those fees are typically put on to utility bills, then that will be the case for you as well,” Dodge said.

Crown land

In the question-and-answer chat, Siobhan Dreelan asked whether St. Albert will work with the Riverlot 56 Natural Area Society and Poundmaker’s Lodge Treatment Centre Society in preserving the former Edmonton Indian Residential School site, which sits on the annexation land.

“Survivors have informed us of the unmarked grave sites on both sites of the Riverlot and Poundmaker’s,” Dreelan said in the chat.

Francis noted the land ownership of both Riverlot 56 and the Poundmaker’s site is under provincial jurisdiction, and St. Albert’s plan for the lands is have them remain as they are.

Developing the 60/40 split

Mike Yochim, director of operations at Landrex, posed a question in the chat asking about the city's plans should the demand for commercial development not hold true in the future.

“If [the] market doesn’t demand 40-per-cent commercial development, how will we maintain increased growth within St. Albert?” Yochim asked in the chat.

Kristina Peter, manager of St. Albert’s planning branch, said the annexation area will be developed further down the road in the coming decades.

“We’re looking into our future needs, and what we’ve heard from the city of St. Albert and its residents and business owners is that they would like to move the bar on the tax assessment and get it a little less reliant on residential taxes,” Peter said.

Peter added the land will help to achieve some of the MDP goals, noting the MDP plans to grow St. Albert’s population to 100,000 and add another 13,000 jobs.

“MDPs are long-range plans and things change over time,” Peters said. “If we end up increasing densities in residential development … we may see the tax split isn’t as simple as it is today.”

After the city hears back from the province about the lands, the planning department will bring proposed bylaw amendments to council in January of 2022.